Smart Saver: Secure & Profitable

Smart Saver is designed for those looking for a secure, short-term investment option with attractive returns. With an interest rate of up to 12.12%, and the flexibility to invest as low as INR 100, Smart Saver is ideal for new and seasoned investors alike.

Features:

Flexible investment amount starting from INR 100

Begin your investment journey with minimal capital while enjoying substantial returns.

Investment tenure ranging from 3 to 12 months

Choose a flexible investment period that suits your financial planning.

Regulated by RBI for your peace of mind

Rest assured that your investments are secure and compliant with RBI regulations.

Benefits:

- Higher returns compared to traditional savings accounts.

- Short-term investment horizon.

- Secure and regulated investment option.

How to get started

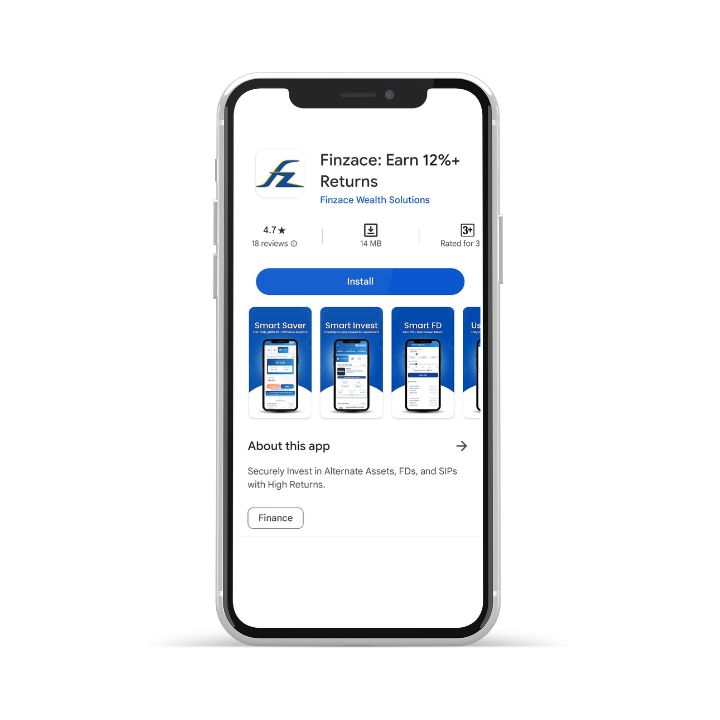

Step 1

Download The Finzace App

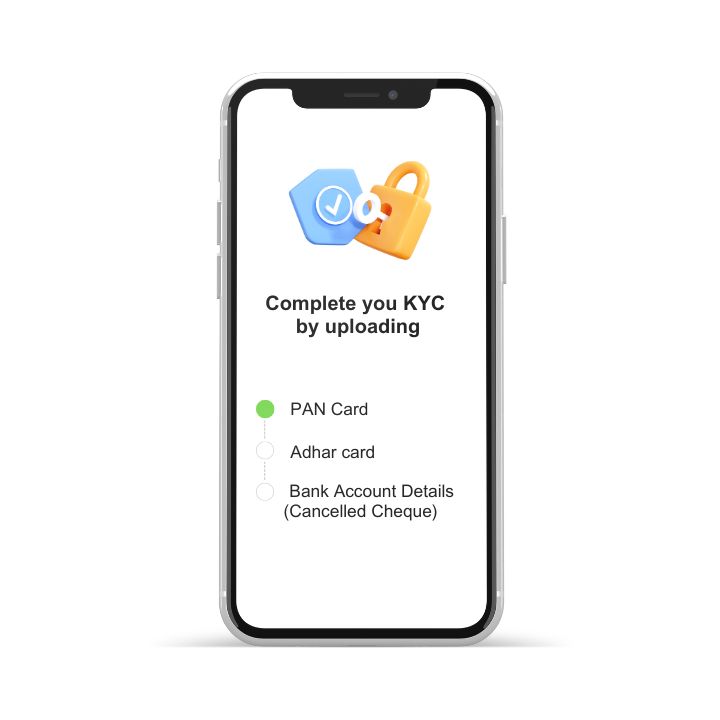

Step 2

Sign up & Complete your Kyc

Create your investment account with the Finzace

Step 3

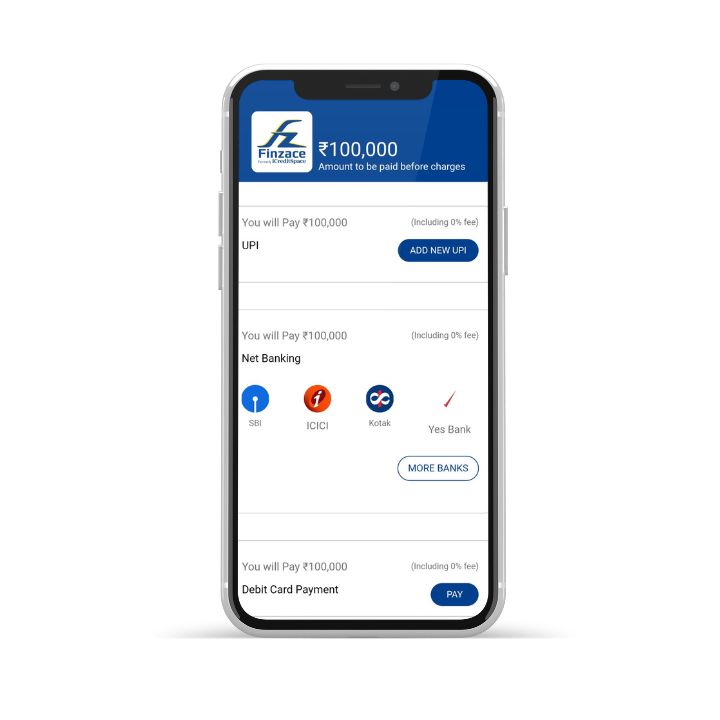

Add funds to wallet

Deposit the amount you want on escrow account.

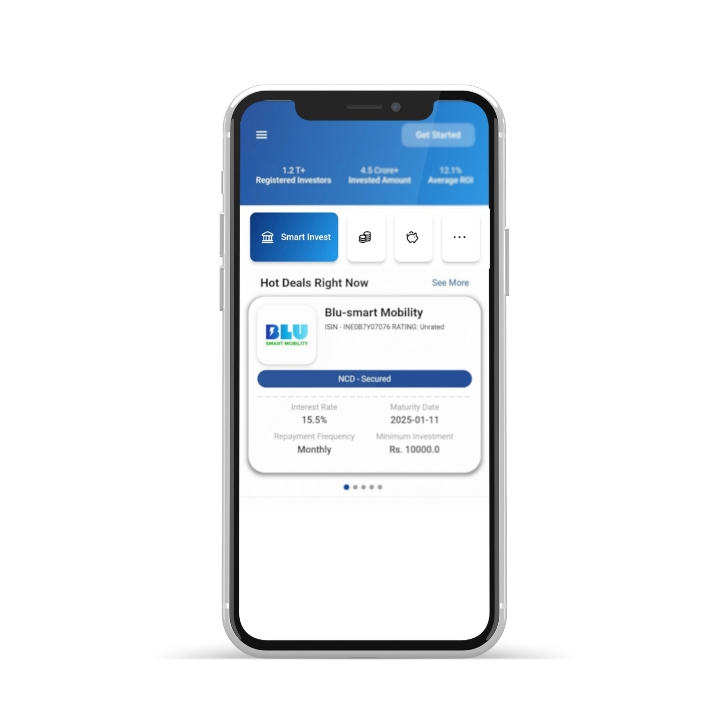

Step 4

Start saving now

Click on Smart Invest and begin your investment journey.

Frequently Asked Questions

What is Smart Saver?

Smart Saver is a fixed-income product offered by an RBI-regulated NBFC-P2P platform. This platform connects investors directly with borrowers, enabling them to earn fixed returns through interest payments.

How much can I invest in Smart Saver?

You can start with as little as ₹100. For investments above ₹10 lakh, a net worth certificate is required.

What returns can I expect?

Expect returns between 10% to 12.12% on your investment depending on the tenure.

When will I receive my returns?

Returns are credited after the completion of your selected investment tenure.

Is there a lock-in period for my investment?

Investment tenures vary from 1 to 12 months, depending on your choice.