Fixed Deposit:

Your trusted Deposit partner

Welcome to Fixed Deposit, where we bring you lucrative and secure investment opportunities through Corporate Fixed Deposits with some of the leading banks and NBFCs in India. If you’re seeking higher returns than traditional bank fixed deposits without compromising on the security of your investments, Fixed Deposit is your ideal choice.

What is Fixed Deposit?

Finzace’s premier fixed deposit product that allows you to invest in Fixed Deposits with trusted institutions across India, including Banks and Non-Banking Financial Companies (NBFCs). These corporate FDs typically offer higher interest rates compared to regular bank deposits, enabling you to maximize your returns.

With Smart Deposit, you get:

- Exclusive Offers: Access competitive interest rates from leading corporations and NBFCs.

- Flexible Tenure: Choose deposit periods that suit your financial goals.

- Guaranteed Returns: Enjoy fixed, predictable returns over your chosen tenure.

- Safety: All Bank Fixed Deposits are insured by Reserve Bank of India’s subsidiary DICGC, up to INR 5,00,000.

- Benefits: Get more returns for senior citizens and first of its kind women benefits.

Why Choose Finzace Fixed Deposit?

- Higher Returns: Smart Deposits offer rates that are typically 1-2% higher than traditional bank fixed deposits, making it a smarter way to grow your wealth.

- Diversified Choices: We partner with reputed banks and NBFCs to bring you a wide range of fixed deposit options that suit varying risk appetites and investment horizons.

- Security: All the FDs offered through Smart Deposit are insured up to INR 5,00,000 by DICGC (subsidiary of the Reserve Bank of India) and come from companies with institutions with credit ratings, ensuring your investment remains safe while delivering attractive returns.

- Convenience: Invest in corporate FDs from the comfort of your home through our simple, transparent, and digital onboarding process.

Key Benefits of Smart Deposit

- Higher Interest Rates: FDs generally offer higher interest rates compared to regular bank FDs.

- Flexible Investment Options: You can choose between short and long tenures, based on your financial goals.

- Instant Withdrawals: Enjoy liquidity with options for instant withdrawal.

- Insurance: Up to INR 5,00,000 insured by Reserve Bank of India’s subsidiary DICGC.

- Tax Benefits: Save on taxes with deposits under certain conditions, depending on the tenure and amount invested.

How Does It Work?

Browse Available Options:

Compare and select from a curated list of corporate FDs based on your preferred interest rate, tenure, and the credit rating of the institution.

Invest Digitally:

Complete the entire investment process online with minimal documentation, ensuring a hassle-free experience.

Earn Returns:

Sit back and watch your investment grow with fixed, reliable returns.

How Does It Work?

- Browse Available Options: Compare and select from a curated list of corporate FDs based on your preferred interest rate, tenure, and the credit rating of the institution.

- Invest Digitally: Complete the entire investment process online with minimal documentation, ensuring a hassle-free experience.

- Earn Returns: Sit back and watch your investment grow with fixed, reliable returns.

How to get started

Get Started with Fixed Deposit Today

Make the smart choice for your financial future. With Finzace Fixed Deposit, you get higher returns, flexibility, and a secure investment platform – all at your fingertips.

Click here to explore our investment options or get in touch with us at info@icreditspace.com or call us at: +91 8861448933 for more details.

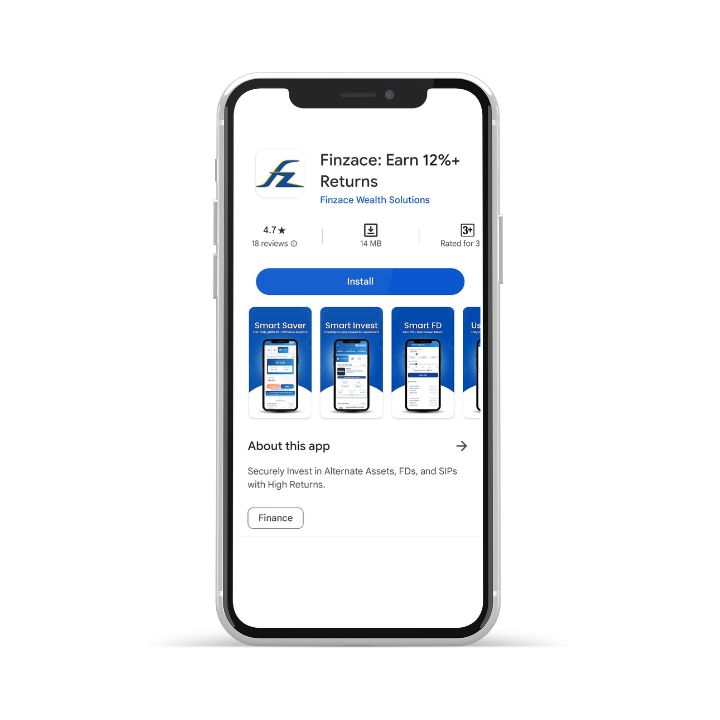

Step 1

Download The Finzace App

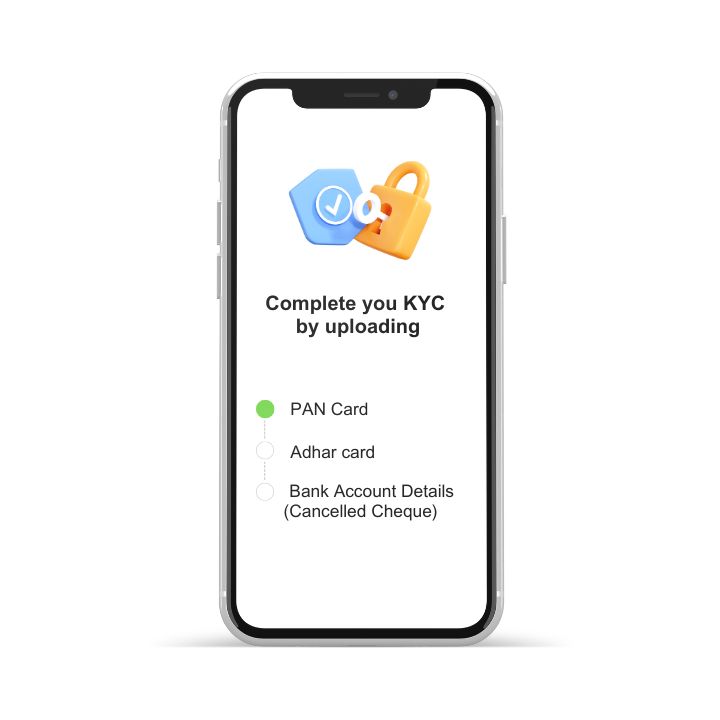

Step 2

Sign up & Complete your Kyc

Create your investment account with the Finzace

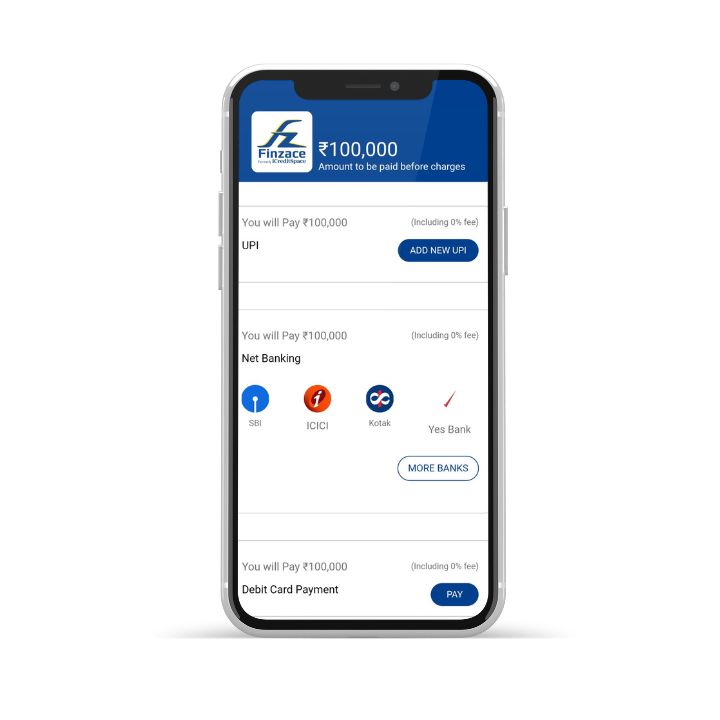

Step 3

Add funds to wallet

Deposit the amount you want on escrow account.

Step 4

Start saving now

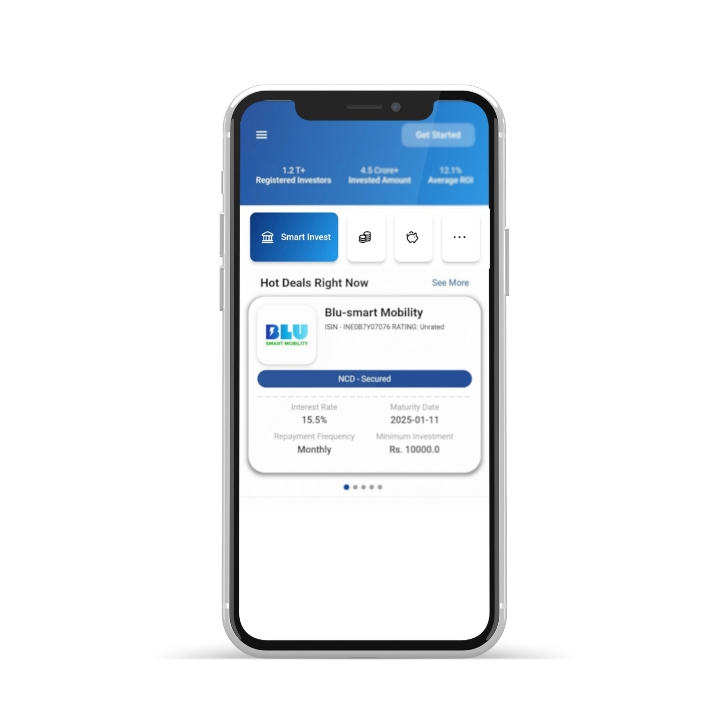

Click on Smart Invest and begin your investment journey.

Frequently Asked Questions

What is a Fixed Deposit?

Fixed Deposit is a corporate fixed deposit product by Finzace, offering higher interest rates than traditional bank FDs, designed to maximize returns while keeping your investment secure.

How does Fixed Deposit differ from traditional Fixed Deposits?

Fixed Deposits provide competitive interest rates compared to traditional bank FDs, with a focus on short to mid-term tenures and potentially higher yields, offering a reliable investment option for your funds.

Who is eligible to invest in a Fixed Deposit?

Any Indian resident above 18 years with a valid PAN and bank account can open a Smart Deposit. It’s an ideal option for both new and experienced investors seeking stable returns.

What is the minimum investment amount for a Fixed Deposit?

You can start a Fixed Deposit with as little as ₹1,000, making it accessible for a broad range of investors.

What returns can I expect from a Fixed Deposit?

Fixed Deposits offer attractive interest rates up to 9.5%, often higher than standard FDs. The exact rate depends on the chosen product, tenure, additional benefits such as senior citizen or women benefits and will be disclosed upfront at the time of investment.