What is DICGC and how does it work?

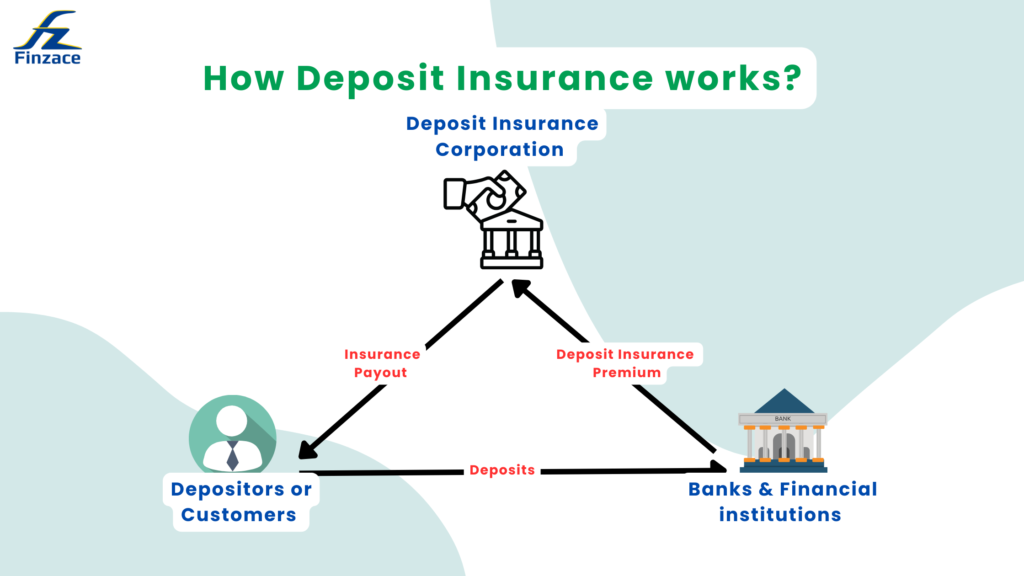

Deposit Insurance and Credit Guarantee Corporation (DICGC) is a subsidiary of the Reserve Bank of India. It offers deposit insurance, which serves as a safety net for bank depositors if the bank is unable to pay them.

Up to a maximum of Rs. 5 lakh per account holder per bank, the agency covers all types of deposit accounts held by banks, including savings, current, recurring, and fixed deposits. If a person has more than Rs. 5 lakh in deposits in a single bank, DICGC will only pay Rs. 5 lakh (principal and interest included) if the bank fails.

Management

If a bank has elected for DICGC coverage, depositors’ funds held in all commercial and international banks operating in India, as well as central, state, and urban co-ops, regional rural banks, and local banks, are protected.

The Deposit Insurance and Credit Guarantee Corporation Act, 1961, and the Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961, which were drafted by the RBI under the terms of Section 50, subsection (3) of the act, govern the agency’s operations. According to the laws, this corporation was established to guarantee credit facilities, insurance for deposits, and other relevant things.

What does DICGC insure?

· The DICGC insures all deposits such as savings, fixed, current, recurring, etc. deposits except the following types of deposits

· Deposits of foreign Governments;

· Deposits of Central/State Governments;

· Inter-bank deposits;

· Deposits of the State Land Development Banks with the State cooperative bank;

· Any amount due on account of any deposit received outside India

· Any amount, which has been specifically exempted by the corporation with the previous approval of the Reserve Bank of India

DICGC covers each depositor of the bank up to 5,00,000 (Rupees Five Lakhs) for principal and interest amounts held by them in the same capacity and right as on the date of the bank’s license cancellation, liquidation, or scheme of amalgamation, merger, or reconstruction comes into force.

How is the bank involved with DICGC?

Every bank has to mandatorily register with the DICGC and has to pay a premium of 6.75% on the total deposits to the agency.

If a bank enters liquidation, DICGC is required to reimburse the liquidator for each depositor’s claim amount up to ₹5 Lakhs within 2 months of the liquidator’s claim list being received. Each insured depositor must get a payout from the liquidator equal to their claim amount.

When a bank files for bankruptcy, the liquidator compiles a list of claims organized by depositors and submits it to the DICGC for review and processing. The liquidator, who is responsible for paying the depositors, receives payment from the DICGC. The amount owed to each depositor in the event of a bank merger or amalgamation is transferred to the receiving bank.

What should the depositor know before putting money in a Fixed Account?

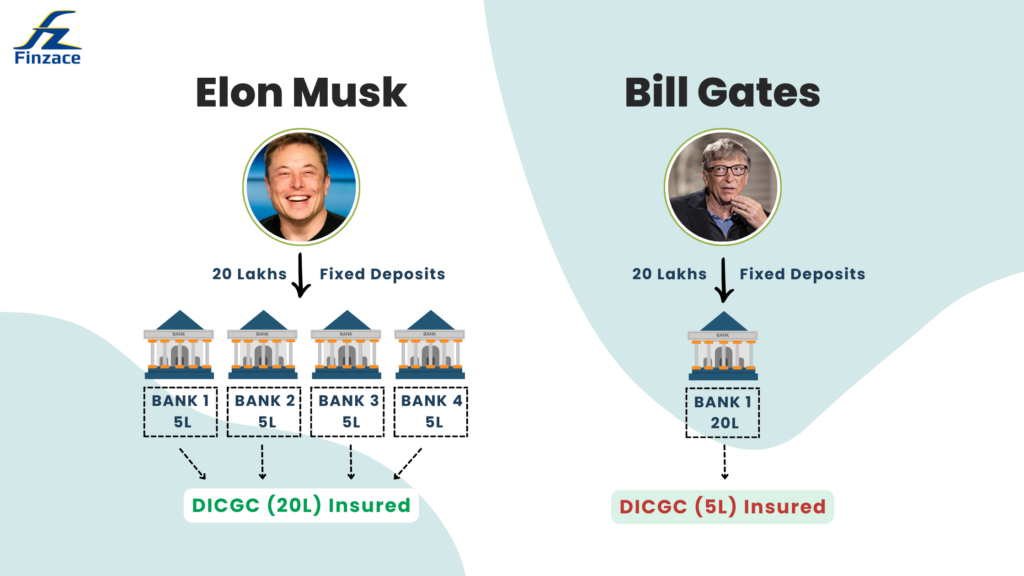

When a Depositor opens multiple deposit accounts in different branches of a bank, for instance, Elon Musk opens multiple current savings accounts, fixed deposit accounts, and multiple recurring deposit accounts, in the same bank, these accounts are all regarded as being held in the same capacity and with the same rights. As a result, the combined balances of all these accounts enable insurance coverage of up to Rs. 5 lakhs.

How safe are bank FDs and should you invest?

Investing in bank Fixed Deposits (FDs) is often considered a secure choice for individuals seeking safety and consistency in their investments. With FDs, the invested money is locked in with the bank for a predetermined tenure, and upon maturity, the depositor receives the initial amount along with a specified interest. However, before opting for this seemingly stable investment avenue, it’s crucial to be mindful of certain key factors that can significantly impact the returns:

1. Liquidity Risk: One essential consideration is the potential liquidity risk associated with bank FDs. If a depositor needs to withdraw the FD before its maturity period, the bank may impose penalties, diminishing the total earnings on the investment. This restriction can limit the flexibility of the investment, making it important to carefully assess one’s liquidity needs before committing to an FD.

2. Real Return and Inflation: Another factor to weigh is the real return, which is the return adjusted for inflation. If the FD interest rate is lower than the prevailing inflation rate, the real return might turn negative. In the context of India, where the inflation rate stands at 7.44% and banks offer FD interest rates ranging from 4 to 7%, depositors could experience a reduction in their purchasing power over time due to this negative real return. It’s essential to evaluate whether the FD interest rate outpaces inflation to preserve the actual value of the investment.

3. Economic Turmoil and Fluctuating Rates: Economic uncertainties, especially during periods of turmoil, can lead to fluctuations in key financial indicators such as repo rates. These fluctuations, in turn, directly impact FD interest rates offered by banks. During times of economic instability, the interest earned on FDs may decrease, affecting the overall returns on the investment. Prospective investors should stay informed about the economic landscape and its potential impact on FD rates to make informed decisions.4. Impact of tax on FD: Starting in April 2019, PAN users will be required to pay 10% tax and non-PAN users will pay 20% tax on interest generated if the interest on FD is greater than ₹40,000. When the annual interest is credited, this interest would be subtracted as TDS (tax deducted at source). The ₹40,000 maximum limit is only applicable to individual FDs and does not apply to aggregate earnings.

1. Is it safe to deposit money with high FD interest rates in new emerging banks instead of trusting traditional banks?

Nowadays the newly emerging small finance banks are offering very high interest rates on FDs.

| Unity Small Finance Bank | 9% |

| Suryoyday Small Finance Bank | 7.75% |

| Punjab National Bank | 6.5% |

| ICICI, Axis Bank, and SBI | 7.1%. |

Unity Small Finance Bank is offering 9% at a tenure of 2 to 3 years, and Suryoyday Small Finance Bank is offering 8.6% DCB Bank is attracting customers at a 7.75% interest rate. Whereas traditional banks like Punjab National Bank are offering 6.5%, ICICI, Axis Bank, and SBI are catering at 7.1%.

So the question arises here, how safe is it to deposit in those high interest rates?

In the last five years, there have been several private banks and small finance banks (SFBs) that have collapsed in India. This has raised concerns about the health of the Indian banking sector and the effectiveness of regulatory oversight. Banks like Yes Bank, and Lakshmi Vilas Bank collapsed due to poor governance, high NPA, and liquidity issues. Artha Prima Small Finance Bank (APSFB) and PMC Bank failed in 2019 due to high NPAs and liquidity problems. Banks play a vital role in the economy by providing credit to businesses and consumers. When banks collapsed, it disrupted economic activity and led to job losses. Depositors and investors in collapsed banks can lose their money. This had a devastating impact on their financial well-being. Also, we know right now the economy is going through recession and lots of geo-political events are adversely affecting the economy. So investors need to think before jumping into the lucrative offers.

The Reserve Bank of India (RBI) has increased the repo rate by 250 basis points (bps) since May 2022, which has made fixed deposits once more an appealing investment for fixed-income investors. Because fixed deposit interest rates are rising, investors can earn returns on their investments of more than 9% while still being covered by the DICGC. You read correctly: a tiny number of small finance banks (SFBs) are offering their clients yields on fixed deposits (FDs) of more than 9%, which is much greater than what modest savings plans and banks in the public and private sectors are offering.

Ujjivan Small Finance Bank’s MD and CEO, Ittira Davis, says that fixed deposits (FDs) are a wise investment for customers, particularly in light of the current rate hikes. FDs provide a reliable, secure investment with profits that are assured. They are ideal for risk-averse investors because they are low-risk. With FDs, customers may easily invest their money for a predetermined period of time and get returns. Better interest rates are also available with FDs than with savings accounts and other low-risk investments. Clients looking for a steady income stream can profit from FDs.

Anita Gandhi, Head of Institutional Business, Arihant Capital Markets Ltd., Full-Time Director

According to the RBI, small financing banks have been established to provide basic banking services to underserved and unserved groups, including farmers, small businesses, and others. Their interest rates are far greater than those of commercial banks. Because of their substantial net interest margins, they are able to provide higher interest rates. They raise capital for the less developed sectors of the economy. In the event that a bank fails, the RBI has guaranteed deposits held with banks up to five lacs. As a result, deposits of up to $5 lacs can be made safely in these institutions.

Investing in small financial institutions with above 9% return on FDs may be a good option for people seeking higher rates than traditional banks. It’s critical to assess the bank’s performance and reputation before making an investment. Investors should think about their risk tolerance and financial goals before making any decisions on investments.

2. What are the risks associated with it?

Among the risks associated with investing in small financial institutions include the possibility of payment default, problems with liquidity, and potential interest rate swings. You should investigate the bank and consider its past performance and financial health before placing an investment.

3. How should I approach my investments?

A prudent investing strategy would take the FD’s term into account and ensure that the portfolio is diversified across multiple asset classes. Investors also need to take into account the fact that larger rewards usually come with more risk.

4. Should I lock up my FD for 80c deductions at a small financing bank?

It would be beneficial to lock in an FD at a small finance bank for 80C deductions for tax purposes. However, take into account the lock-in time because early withdrawals may result in fines. Investors should compare the potential returns to alternative investing possibilities before making a decision.

CAL Manish Mishra, the CFO Virtually

SFBs were created to provide financial services to underbanked and unbanked parts of society, with a focus on microfinance and small business loans. They are governed by RBI regulations and offer deposit products such as current accounts, savings accounts, and fixed deposits.

The higher interest rates may sound enticing despite the risky nature of investing in FDs issued by SFBs. Due to their relative youth, SFBs’ financial soundness may not be as well-established as that of larger banks. As a result, investing in SFBs may be riskier.

The interest rates offered by SFBs are subject to fluctuate depending on market conditions, thus the 9% interest rate that is being offered now could not be available tomorrow.

Investors considering making an investment in FDs need to consider the tax implications because the interest on FDs is taxable. Furthermore, SFBs might not provide tax-saving FDs, in contrast to certain other banks.

FDs are a low-risk investment option for cautious investors looking for steady returns. However, an investor may wish to consider different investing options, such as stocks or mutual funds, if they are looking for higher returns.

In conclusion, some investors might discover that purchasing FDs from SFBs is a smart move, but it’s important to carefully consider the benefits and drawbacks before making a decision. Furthermore, prior to making

WealthinIndia.com’s founder, Sahen Karamchandani (Wii Investments Private Limited)

Investors should consider the risk involved with Small Finance Bank FDs before making any decisions on their investments, even though they have a 9% return. The primary risk associated with investing in Small Finance Bank FDs is credit risk. However, deposits made with small finance banks are also covered by the DICGC, a section of the RBI that oversees all bank deposits up to Rs. 5 lakh. Therefore, one need not worry about principal or interest when investing up to Rs. 5 lakh. Any additional investment amount needs to be directed toward alternative investment opportunities.

Another option for investors looking for greater returns is debt mutual funds. Bonds, government securities, and other fixed-income instruments are investments made by these funds. Debt mutual funds have more liquidity, offer larger yields than bank FDs, and are tax-efficient for investors in lower tax bands.

Ventura Securities’ Director, Juzer Gabajiwala

Here are two decisions that need to be taken into account. The first is whether or not to use Section 80C, and the second is whether or not to use a Small Finance Bank (SFB). In your initial choice, you should only choose section 80C if the previous tax system is advantageous to you; otherwise, you should only choose a tax-saving FD. There is no benefit to the section 80C fixed deposit if you choose to use the new tax regime. Also, keep in mind that the 1.50 lac restriction will apply to section 80C.

The SFB’s high level of interest served as the foundation for the second judgment. This may be viewed as an investment, but one should make sure the total—principal and interest—does not surpass five lacs. Through DICGC, the RBI offers a guarantee up to Rs. 5 lacs. You should also visit their website to confirm if the bank is on the list of institutions qualified to receive insurance coverage. Therefore, the two decisions stand alone and shouldn’t be related to one another.

Edul Patel, Mudrex’s co-founder and CEO

Investors may be drawn to certain small financing banks that provide fixed deposit (FD) interest rates higher than 9%. Small financing banks, however, can be more susceptible to failure than larger banks because of their greater costs and less capacity to raise capital. Prior to investing, it’s critical to understand your objectives and their level of financial security. FDs have restricted liquidity but promise assured returns. Thus, it is essential to evaluate objectives, identify dangers, and carry out in-depth study before making an investment.

Nehal Gupta, AMU Leasing’s Director

For those seeking a higher interest rate than regular banks, investing in a fixed deposit (FD) with a small financing bank that offers a return of more than 9% may seem like a desirable option. But remember that greater gains are typically accompanied by greater dangers. Due to their smaller capital bases and preference for making unsecured loans to more vulnerable demographics, small financial institutions are more vulnerable to defaults and non-performing assets.

It’s important to thoroughly investigate the bank’s reputation and financial soundness before making an investment. Additionally, investors should spread their interests among a variety of institutions and financial products in order to diversify their portfolios. Tax savings can be achieved by locking in an FD for 80C deductions, but it’s important to balance the advantages above the hazards.

The choice to invest in a small finance bank FD should ultimately be determined by the risk tolerance and personal financial objectives of each investor. A financial advisor can help you decide which investment plan is ideal for you given your particular situation.

Consider exploring investment opportunities with Finzace, a leading investment app in India that provides secure options. Unlike traditional Corporate FDs, Finzace offers attractive returns through its innovative investment feature called “Smart Saver.” With a minimal investment of just Rs. 100, investors can enjoy a remarkable 10% annual interest rate, credited daily. This unique investment plan offers unparalleled flexibility for redemption, making it a hyper-liquid option and a pioneering solution in the Indian financial landscape. Embrace this groundbreaking opportunity to transform your approach to saving and investing. You can draw your money anytime from the account as this is highly liquid and no penalty is imposed for that.