Bonds:

Secure Your Wealth with Stable Returns

Invest in High-Rated Corporate Bonds for Predictable Income

Welcome to Bonds, where we bring you lucrative and secure investment opportunities through high-rated corporate bonds from trusted companies and financial institutions. If you’re seeking higher returns than traditional fixed deposits while ensuring steady income and capital security, Corporate Bonds is your ideal choice.

Features:

Invest in secured corporate bonds

Benefit from the stability of investing in bonds backed by reputable corporations.

Monthly coupon payments

Enjoy regular income through guaranteed monthly interest payments.

Diverse portfolio options to minimize risk

Choose from a variety of investment opportunities to build a balanced and risk-adjusted portfolio.

Benefits:

- Higher returns compared to fixed deposits.

- Regular income through monthly coupon payments.

- Diversified investments for reduced risk.

Investing with Finzace

At Finzace, we understand the importance of making informed investment decisions. Our platform offers transparent, secure, and profitable investment opportunities tailored to meet your financial goals. By investing with Finzace, you can ensure that your money works harder for you, providing you with higher returns and greater financial security.

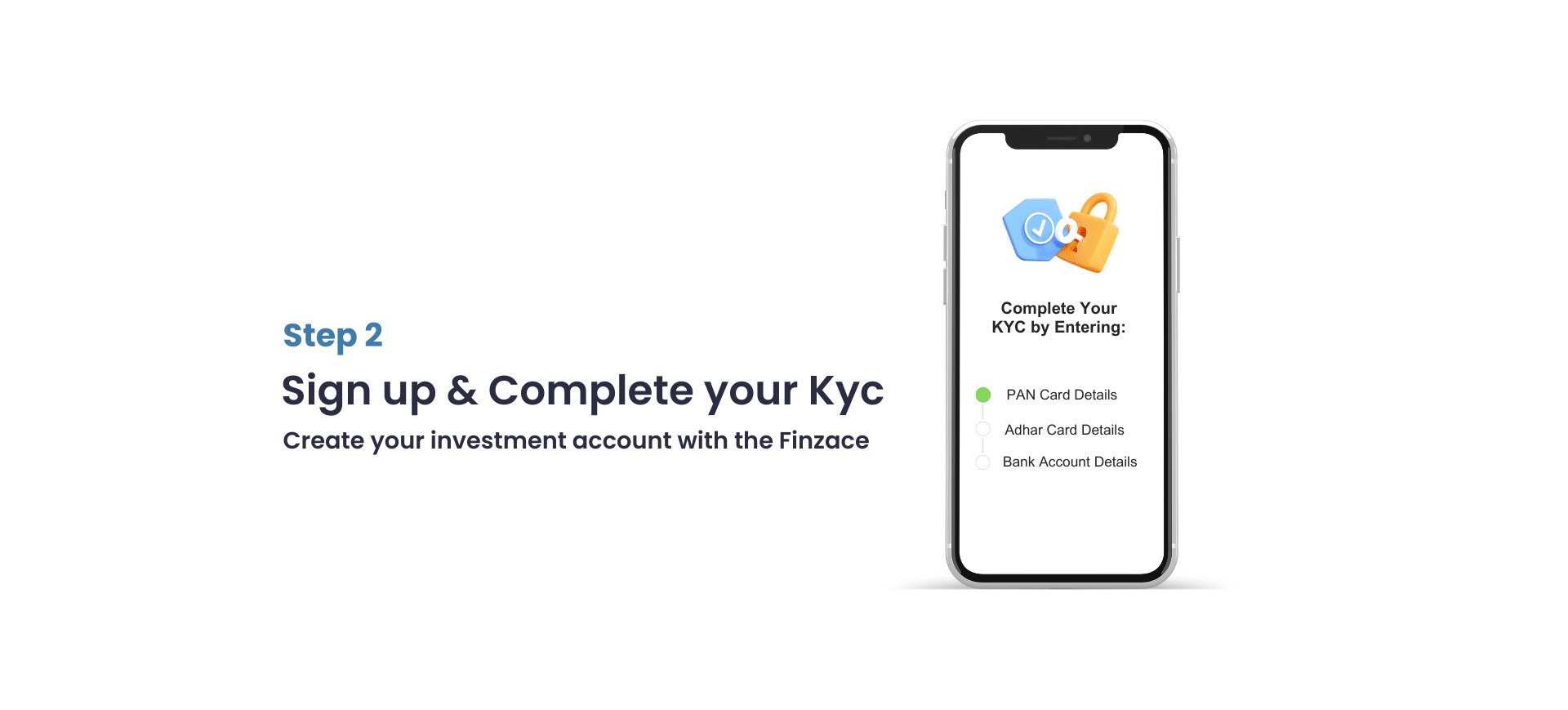

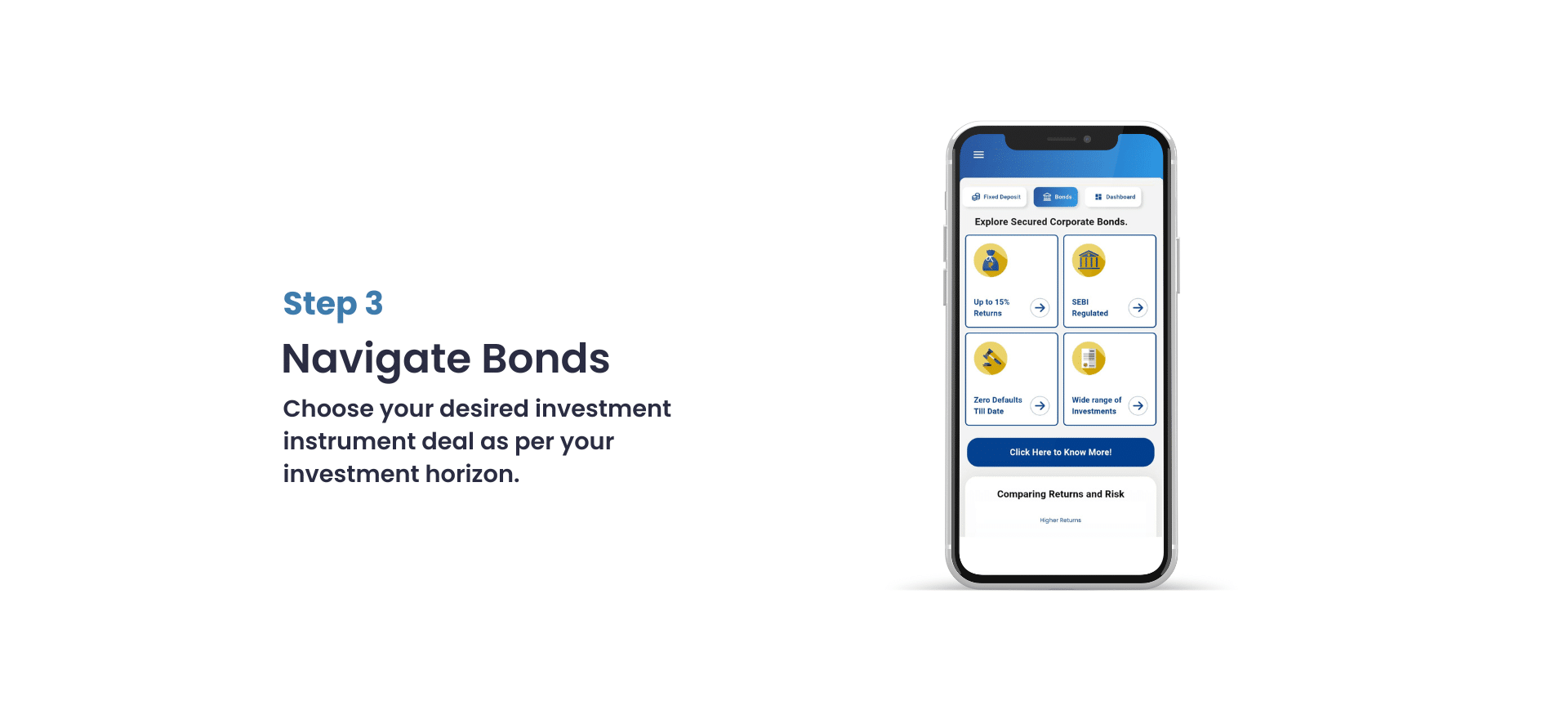

How to get started

Frequently Asked Questions

What are Bonds?

Bonds offers access to alternative fixed-income assets, including Non-Convertible Debentures (NCDs) i.e. corporate bonds, providing high returns up to 16%

How much can I earn with Bonds?

Fixed returns range up to 16%, suitable for both short-term and long-term investment goals depending on the asset and maturity date.

How does Bonds ensure the safety of my investment?

Investments are secured, asset-backed, and compliant with SEBI regulations.

What is the minimum investment amount for Bonds?

Start with as little as ₹10,000 (face value), making it accessible for all types of investors.

How does Bonds support diversification?

Bonds offers diversified investment opportunities across multiple asset classes, promoting wealth growth.

Names You Can Trust