It’s critical to invest your hard-earned money wisely in the changing financial landscape of today. Investigating secured investment possibilities is one of the best strategies to protect your future. Compared to unsecured investments, these investments provide a higher level of protection, giving you more financial stability and peace of mind.

Understanding Investments in Finance

Collateral, or an asset that acts as a guarantee for the investment, is what supports security in investments. The lender may take possession of the collateral to make up for any damages incurred if the borrower defaults on the loan. This security may be in the form of valuable assets like real estate or other things of value.

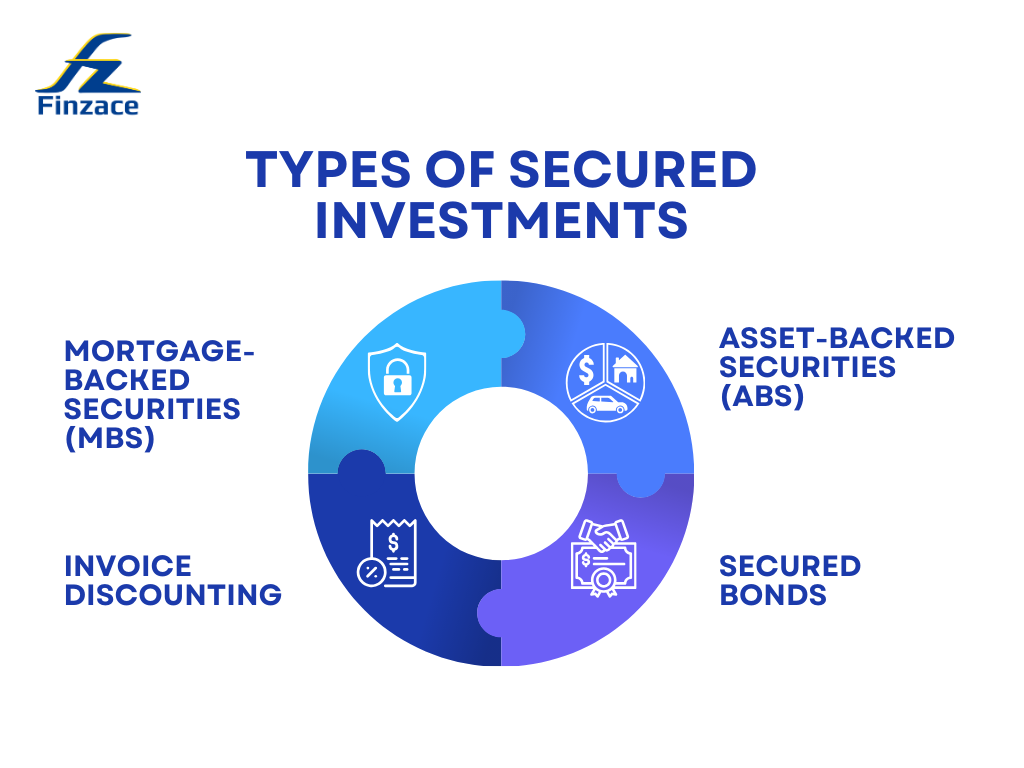

Types of Secured Investments

- Mortgage-Backed Securities (MBS): Debt obligations known as MBSs are claims on the cash flows resulting from mortgage loans. These securities are a relatively low-risk investment option because they are backed by the underlying mortgages.

- Asset-Backed Securities (ABS): Similar to MBS, ABS are secured by other kinds of assets such as student loans, auto loans, and credit card receivables. When compared to other secured investments, ABS can provide better dividends and offer greater diversification.

- Sub-Debt Bonds: Debt instruments backed by particular assets are issued by firms as bonds. Bondholders are entitled to the underlying collateral in the event of an issuer default.

- Invoice discounting: Invoice discounting is a financial service where businesses sell their unpaid invoices to a third party at a discount to improve cash flow. This allows companies to receive immediate funds while the third party collects the outstanding invoice payments from customers.

Why should you look into these options?

- Lower Risk: Because the collateral adds another degree of security to the investor’s protection, secured investments carry a lower level of risk than unsecured ones.

- Potential for Higher Returns: Even while secured investments are typically less risky, they can nevertheless yield competitive returns, particularly when compared to other low-risk investing options like money market funds or savings accounts.

- Diversification: Adding secured investments to your portfolio can lower overall risk and diversify your holdings.

Considerations while Investing

- Understand the Underlying Assets: It is essential to fully comprehend the value, liquidity, and possible hazards of the assets supporting the investment.

- Research the Issuer: Make sure the organization or firm offering the secured investment has a solid financial history and is likely to fulfill its obligations by doing due diligence on them.

- Consider the Investment Term: Make sure the organization or firm offering the secured investment has a solid financial history and is likely to fulfill its obligations by doing due diligence on them.

Benefits for Investors

- Sense of Security: Secured investments, such as corporate bonds, offer a sense of security to investors as they are backed by collateral, providing a feeling of safety for their investments.

- Predictable Returns: Secured investments typically offer predictable returns, ensuring that investors can expect a fixed income from their investments.

- Low Risk: Secured investments are generally considered low-risk, as they are backed by assets or collateral, which reduces the risk of loss for investors.

- High Returns: Finzace offers secured investments with high returns, such as 15% returns, making them an attractive option for investors seeking steady growth and income.

- Diversified Portfolio: Secured investments allow investors to diversify their portfolios by adding fixed-income assets, which can help reduce overall portfolio risk.

- Informed Choices: Finzace empowers investors to make informed choices about their investments by providing a platform that offers multiple secured investment options.

Conclusion:

Secured investments offer a compelling option for those looking to safeguard their financial future. By understanding the different types of secured investments and their associated benefits and risks, you can make informed decisions that align with your investment goals and risk tolerance. As always, it’s recommended to consult with a financial advisor to develop a personalized investment strategy that meets your unique needs and circumstances.

Secured investments, backed by collateral like real estate or other assets, offer added security and lower risk compared to unsecured investments. Key types include Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS), Real Estate Investment Trusts (REITs), and secured bonds.

Benefits include lower risk, competitive returns, diversification, and predictable income. However, it’s essential to understand the underlying assets, research issuers, and consider investment terms. Consulting a financial advisor can help tailor a strategy to your needs.

Finzace, our cutting-edge investment app, offers a range of secured investment options tailored for the Indian market, ensuring both high returns and low risk. With Finzace, you can explore the best fixed-return investments in India, including high-yield corporate bonds and Non-Convertible Debentures (NCDs), which provide attractive returns and stability. Our platform features a selection of low-risk investment options such as Mortgage-Backed Securities (MBS) and Asset-Backed Securities (ABS), delivering competitive yields while safeguarding your capital. For those seeking the best safe investments with high returns, Finzace curates top-performing secured investments, ideal for both short-term and long-term goals. Additionally, our app simplifies investing in high-return fixed-income products, ensuring you can effortlessly build a diversified and secure portfolio.

Download our app now!!

Download link (Android): https://play.google.com/store/apps/details?id=icreditspace.com

Download link (Apple): https://apps.apple.com/in/app/finzace-earn-12-returns/id6446245952