History

The concept of peer-to-peer lending has its roots in ancient credit circles and community lending initiatives. However, the modern iteration we know today emerged in the early 2000s, fueled by advancements in technology and the growing desire for financial alternatives. 2005 marks the official birth of P2P lending with the launch of Zopa in the UK, followed by Prosper and LendingClub in the US. These platforms connected borrowers directly with lenders, cutting out traditional banks and their fees. Even though people were skeptical initially, P2P lending gained traction during the 2008 financial crisis. Traditional banks tightened credit, leaving borrowers with limited options. P2P platforms, with their flexible criteria, filled the gap, offering loans to small businesses and individuals.

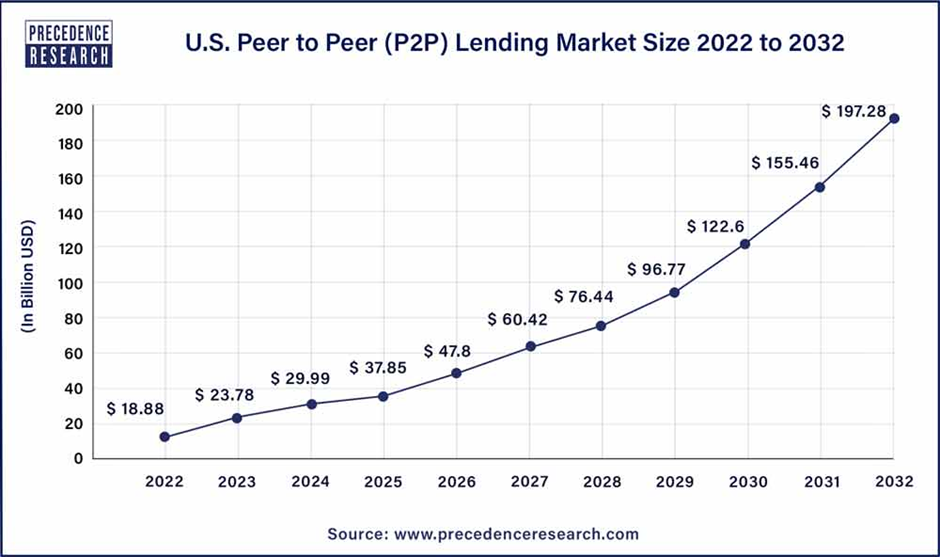

What Is The Stat Showing?

Global peer to peer P2P lending market revenue is estimated to reach USD 804.2 Billion by 2030 with a CAGR of 29.1% from 2022 to 2030.

The U.S. peer to peer (P2P) lending market size reached US$ 18.88 billion in 2022 and it is predicted to expand US$ 197.28 billion by 2032 with a CAGR of 26.50% from 2023 to 2032.

Current situation in Europe, USA, China and India

The UK birthed P2P lending in 2005 with Zopa and saw steady growth for years, averaging 21.2% annually between 2017-2022. By 2022, the market reached £370.7 million in revenue. Tax benefits like the IFISA since 2016 and regulations under the FCA have fueled investment and ensured accountability. This mature P2P market, with platforms like Funding Circle boasting £6.3 billion in loans, looks set for continued growth.

The 2008 financial crisis pushed US borrowers to P2P platforms, and LendingClub became the largest platform by 2013. As investor trust shifted and traditional banks jumped in, the industry matured. Now, North America leads with a $18.88 billion market in 2022, expected to balloon to $197.28 billion by 2032 (26.5% annual growth). While regulations remain fragmented, with the SEC overseeing investments and the CFPB/FTC managing borrowing, this mature market is primed for a bright future.

P2P lending arose in the UK to challenge unfair bank practices and boost competition. China joined the scene two years later, focusing on micro-financing with Papaidai, launched in Shanghai. By 2015, China’s market exploded, with 3464 platforms, becoming the world’s largest with $217 billion in outstanding loans. This rapid growth, fueled by alternative financing needs, government support, and digital adoption, was deemed “barbaric” and unsustainable. A turning point came in 2016 with the Ezubao Ponzi scandal and increased regulation. Two waves of platform failures followed, shrinking the market by 90% within three years. Stricter rules and deleveraging campaigns continue to reshape the industry, leaving it much smaller but hopefully more responsible.

Launched in 2012, P2P lending in India remained in its early stages but experienced significant growth. P2P lending in India boomed with rapid platform growth from 2 to 40 within three years, fueled by convenient online transactions and filling a credit gap for small businesses. However, concerns arose after the Chinese P2P market’s collapse due to lack of regulation and investor losses.Recognizing this risk, the Reserve Bank of India proactively implemented regulations in 2017 to ensure fair practices and prevent a similar scenario.This early intervention aimed to guide the sector’s healthy growth while safeguarding investors and borrowers. The industry subsequently received validation and increased interest from market participants.

What does the future hold for India in P2P Lending?

India’s P2P lending scene is growing exponentially. With a projected 21.6% CAGR, it’s set to rocket past $10 billion by 2026. This isn’t just pie-in-the-sky talk – regulation has already fueled significant growth, turning P2P into a thriving alternative asset class for investors.

Bigwigs of fintech are circling, eager for a slice of this growing market. Because of increasing transparency powered by technology, trust is taking flight. In a country aiming for a $5 trillion economy, P2P lending acts as a crucial lifeline for credit-starved segments of the population. Tech is also fueling the ascent, making platforms more efficient and responsive to consumer needs, from onboarding to loan disbursement. This isn’t just a baby learning to walk – P2P lending in India has taken giant leaps since its recognition, and with more innovation and players entering the game, the sky’s the limit.