High-Yield NCDs: High Five or High Risk?

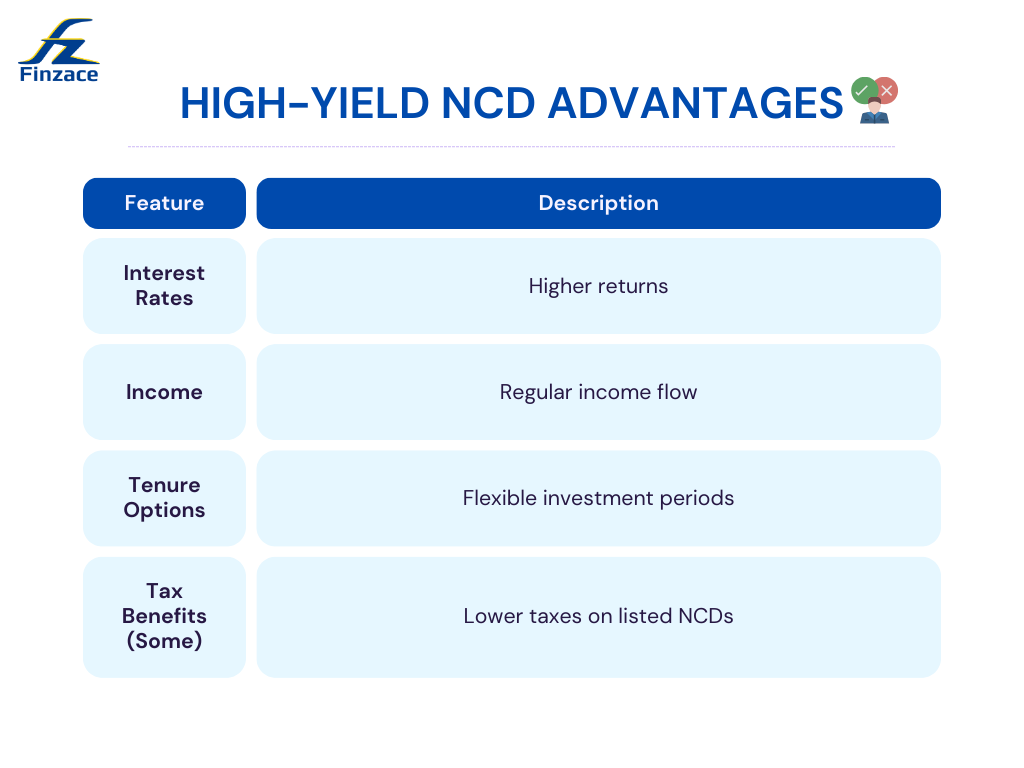

High-yield NCDs promise big returns, like winning the lottery at a concert! They pay more than boring savings accounts and get you regular cash flow. You can even pick how long you invest (think short concert or long tour). Sounds good, right?

But hold on! There’s a chance the company issuing the NCD could go broke, leaving you with nothing (like a canceled concert with no refund!). These NCDs are often risky because the companies aren’t the strongest.

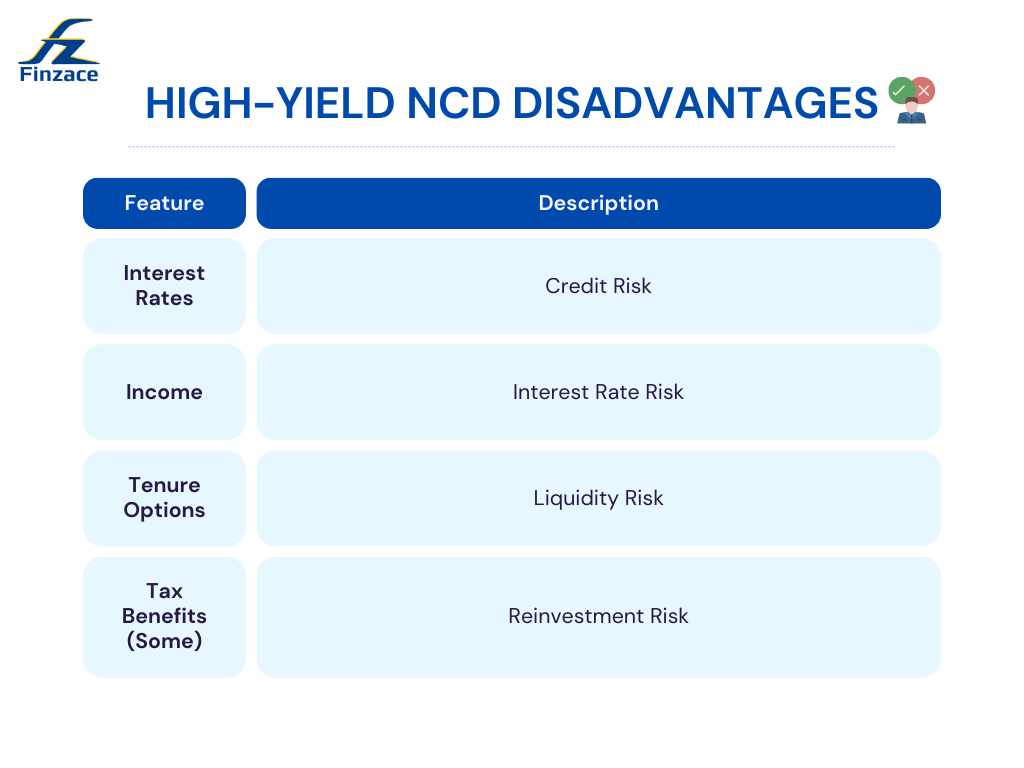

Here’s the lowdown on the risks:

- Company Fiasco: The company might not be able to pay you back (like a band that skips town).

- Interest Rate Rollercoaster: If interest rates go up, your NCD might be worth less (like an old concert ticket).

- Selling Struggle: It might be tough to sell your NCD before it matures (like trying to find someone to buy your ticket).

- Reinvestment Rhythm: When your NCD ends, you might have to reinvest at lower rates (like a concert with a boring opening act).

- Inflation Blues: Inflation can eat away at your returns (like overpriced concert snacks!).

Don’t ditch the concert just yet! Here’s how to make high-yield NCDs work:

- Check the Band’s Rep: Make sure the company issuing the NCD is reliable (like a band with good music!).

- Spread the Music: Invest in different things, not just NCDs (like buying music from various artists).

- Mix It Up: Invest in NCDs with different maturity dates (like going to concerts throughout the year).

- Stay Informed: Keep an eye on what’s happening in the economy (like following music news).

- Get Help: Talk to a financial advisor for personalized advice (like hiring a concert planner).

High-Yield Bonds in India: A Balancing Act Between Risk and Reward

High-yield bonds, also known as junk bonds, are a tempting proposition for Indian investors seeking higher returns. These bonds offer attractive interest rates compared to traditional fixed deposits and government bonds. However, the situation in India right now presents a complex picture with both potential benefits and significant risks to consider.

The Allure of High-Yield Bonds:

- Higher Returns: These bonds are issued by companies with lower credit ratings, and the higher risk they carry translates to higher interest rates for investors. This can be particularly appealing in a scenario where traditional fixed-income options offer stagnant returns.

- Diversification: High-yield bonds can add diversification to your portfolio, potentially improving overall returns and mitigating risk associated with equities.

The Risks to Consider:

- Credit Risk: The biggest concern with high-yield bonds is credit risk. Since the issuing companies are not as creditworthy, there’s a higher chance of them defaulting on interest payments or principal repayment. This can lead to significant financial losses for investors.

- Interest Rate Sensitivity: High-yield bonds are more sensitive to changes in interest rates compared to government bonds. If interest rates rise, the value of existing high-yield bonds with lower interest rates can decline.

- Liquidity Challenges: While listed on stock exchanges, high-yield bonds can be less liquid compared to government bonds. This means it might be difficult to sell them before maturity, especially during economic downturns.

Current Situation in India:

- Mixed Signals: The Indian economy is currently experiencing a recovery phase, but there are some concerns about rising inflation and potential future interest rate hikes. This can create uncertainty for high-yield bonds.

- Increased Issuance: There has been a recent rise in the issuance of high-yield bonds by Indian companies, indicating a growing demand for this asset class. However, this also raises concerns about potential oversaturation in the market.

Investing Wisely in High-Yield Bonds:

- Thorough Research: Before investing, conduct thorough research on the creditworthiness of the issuing company and understand the specific risks associated with the bond.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes and invest in high-yield bonds from various companies with good credit profiles.

- Financial Advisor: Consider seeking guidance from a financial advisor who can assess your risk tolerance and tailor your investment strategy accordingly.

- Long-Term Perspective: High-yield bonds are best suited for investors with a long-term investment horizon who can withstand potential market fluctuations.

High-yield NCDs can be a good investment, but be aware of the risks!

Do your research, invest wisely, and you might just score a financial hit song! Just remember, there might be a few mosh pits along the way!

For those seeking the best fixed-return investments in India, Finzace stands out as the premier investment app. Whether you’re looking for high-return fixed-income investments or low-risk investment options in India, Finzace provides tailored solutions to meet your financial goals. The platform offers easy access to secured investment options like high-yield corporate bonds and investment in NCDs (Non-Convertible Debentures), ensuring you can maximize returns while minimizing risk.

Finzace also caters to those seeking the best short-term fixed-income investments, offering a curated selection of bonds and deposits with attractive yields. By leveraging the expertise of our experienced fund managers and the user-friendly features of our app, you can confidently navigate the investment landscape and achieve your financial objectives.

Join Finzace today and explore the world of high-return fixed-income investments with the assurance of low-risk investment options in India. Let us help you find the best safe investments with high returns to secure your financial future.