As the financial year unfolds, investors in India are on the lookout for tax-saving avenues to grow their wealth while minimizing their tax liabilities. This comprehensive blog delves into a range of RBI-approved investment options that offer substantial tax benefits for the year 2024, catering to both traditional and emerging investment preferences.

A deep look to RBI-backed traditional tax saving investments in India with low risk and high returns.

A. Equity Linked Savings Schemes (ELSS):

What’s Equity Linked Savings Schemes?

ELSS funds typically have a lock-in period of 3 years, which means investors cannot redeem or withdraw their investment before completion of this period.

(i). Tax Benefits: Under Section 80C of the Income Tax Act, tax deductions of up to Rs. (i)5 lakh are available for investments made in ELSS. Investors may see significant tax savings as a result of this.

(ii). Historical Returns: Returns from ELSS funds have historically ranged from 12% to 18% yearly, though actual results may differ based on the state of the market and the fund’s performance.

(iii). Risk Profile: ELSS funds are more risky than debt or hybrid funds because they are equity-oriented. On the other hand, in the long run, they might also provide larger returns.

(iv). Minimum Investment: While it might vary from fund to fund, the minimum investment amount for ELSS funds is normally between Rs. 500 and Rs. 1,000.

(v). Expense Ratio: The annual operational expenses of an ELSS fund are expressed as an expense ratio, which is a proportion of the assets under management of the fund. This can vary based on the fund, from 0.5% to 25%.

(vi). Flexibility: Although ELSS funds have a three-year lock-in period, investors are free to continue investing after this time if they want. Additionally, they have the choice of dividend reinvestment or payout.

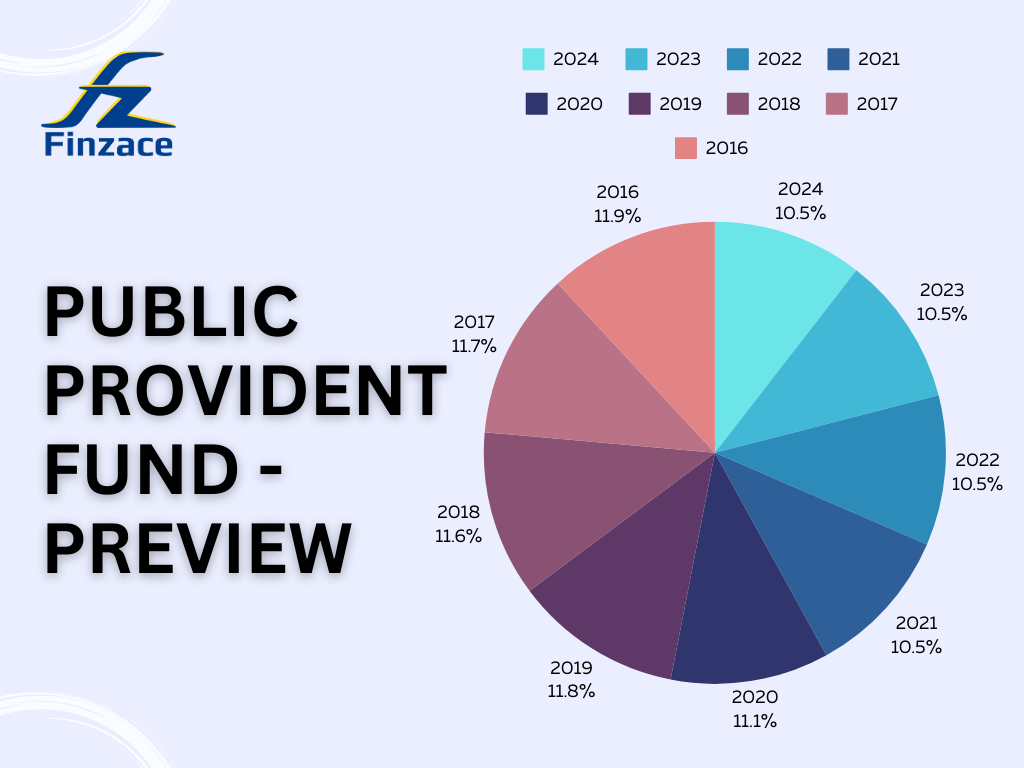

B. Public Provident Fund (PPF):

In India, the government-backed Public Provident Fund (PPF) is a well-liked long-term savings plan. These are PPF’s salient characteristics:

(i) Long-term Investment: PPF is designed as a long-term investment scheme, with a maturity period of 15 years. However, investors have the option to extend the account in blocks of 5 years after maturity.

(ii) Tax Benefits: Contributions made to PPF are eligible for tax deduction under Section 80C of the Income Tax Act, up to a maximum limit of Rs. 15 lakh per financial year. Additionally, interest earned and maturity proceeds are tax-free.

(iii) Interest Rate: The interest rate on PPF is set by the government and is usually higher than bank savings account interest rates. The interest rate is compounded annually and is announced quarterly. It is often linked to government bond yields.

(iv) Minimum and Maximum Contribution: The minimum contribution amount per year is Rs. 500, while the maximum contribution allowed per year is Rs. 15 lakh.

(v) Account Tenure: As mentioned, the initial maturity period of a PPF account is 15 years, which can be extended in blocks of 5 years indefinitely.

(vi) Withdrawal and Loan Facility: Partial withdrawals are allowed from the 7th year of opening the account, subject to certain conditions. Additionally, investors can avail of loans against the balance in their PPF account from the 3rd to 6th financial year.

(vii) Government-Backed: PPF is a government-backed savings scheme, which makes it a safe investment option. The deposits made in PPF accounts are backed by the full faith and credit of the Government of India.

(viii) Ownership and Nomination: Individuals can open a PPF account for themselves or on behalf of a minor for whom they are the guardian. They can also nominate one or more persons to receive the proceeds of the account in the event of their death.

Overall, the PPF is a popular investment avenue in India due to its tax benefits, attractive interest rates, and safety. It is particularly favored by long-term investors who seek stable returns with tax advantages.

– The PPF scheme, known for its long-term savings benefits, comes with a tenure of 15 years and offers tax benefits under Sections 80C and 10(10D).

– Interest earned and maturity amounts from PPF are tax-free, making it an attractive option for risk-averse investors seeking stable returns.

C. National Savings Certificates(NSC):

National Savings Certificates (NSC) is a savings scheme offered by the Government of India aimed at encouraging small to mid-income investors to save regularly while providing them with a safe and attractive investment option. Here are the key features of NSC:

(i) Government-backed Scheme: Because NSC is a government-backed savings plan, investors’ money is extremely safe and secure. The Indian government is in favor of the plan.

(ii) Fixed Interest Rate: NSC offers a fixed interest rate that is determined by the government and is announced periodically. Once you invest in NSC, the interest rate remains fixed for the entire tenure of the investment.

(iii) Investment Tenure: The maturity period of NSC is typically 5 years. However, there are different variants of NSC available with different maturity periods, such as 5 years and 10 years.

(iv) Interest Accrual and Compounding: The interest on NSC is compounded annually, which means it is added to the investment amount at the end of each year, leading to a compounding effect.

(v) Tax Benefits: Under Section 80C of the Income Tax Act, interest generated on NSC is free from taxation up to a certain amount. On the other hand, annual interest is considered reinvested and is eligible for Section 80C tax benefits.

(vi) Minimum Investment: Due to its modest minimum investment requirement, NSC is available to a broad spectrum of investors. Investments in NSC are not subject to any maximum limits.

(vii) Transferability and Nomination: NSC certificates can be transferred from one person to another and from one post office to another. Additionally, investors can nominate one or more individuals to receive the proceeds of the NSC in the event of their death.

(viii) No Premature Withdrawal: NSC has a lock-in period, and premature withdrawal is not allowed. However, in exceptional cases like the death of the holder, premature withdrawal may be permitted subject to certain conditions.

Overall, NSC is a popular savings instrument in India, especially among conservative investors seeking a secure and guaranteed return on their investment.

– NSCs are fixed-income investments with tenures of five or ten years, providing tax benefits under Section 80C.

– While the interest earned is taxable, investors can claim deductions under Section 80C, enhancing their overall tax efficiency.

D. Employee Provident Fund (EPF):

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 established the Employee Provident Fund (EPF), a social security program offered by the Indian government. Its goal is to give workers stability and financial security when they retire.

Here’s an elaborate overview of the Employee Provident Fund (EPF):

(i) Mandatory Savings Scheme: Employees who work for companies covered by the EPF Act of 1952 are required to participate in the EPF savings plan. Contributions to the fund, which is overseen by the Employees’ Provident Fund Organization (EPFO), are made by both the company and the employee.

(ii) Contributions: The contributions to EPF are made monthly and are a percentage of the employee’s basic salary plus dearness allowance. The current contribution rate is 12% of the employee’s basic salary, with a matching contribution from the employer.

(iii) Interest: EPF contributions accumulate interest, which is compounded annually. The interest rate is declared by the government on a yearly basis and is typically higher than most savings schemes offered by banks.

(iv) Withdrawal: EPF allows partial withdrawals for specific purposes such as marriage, education, medical treatment, home loan repayment, and construction/purchase of a house. Complete withdrawal is permitted upon retirement (after the age of 55) or in case of unemployment for a continuous period of more than two months.

(v) Tax Benefits: Contributions made towards EPF are eligible for tax deductions under Section 80C of the Income Tax Act, subject to certain conditions. Additionally, the interest earned on EPF contributions is tax-free, making it an attractive tax-saving investment.

(vi) Universal Account Number (UAN): Each EPF member is allotted a unique Universal Account Number (UAN) by the EPFO, which remains constant throughout the member’s career. The UAN facilitates easy access to EPF-related services and allows for the seamless transfer of EPF accumulations when changing jobs.

(vii) Online Services: EPFO provides various online services to its members, including checking EPF balance, downloading passbooks/statements, updating personal details, and filing withdrawal claims, through the EPF member portal.

(viii) Nomination: EPF members are required to nominate one or more beneficiaries to receive the EPF accumulations in the event of their death. This ensures that the accumulated savings are transferred to the nominee(s) without any hassle.

Overall, the Employee Provident Fund (EPF) serves as an essential retirement savings tool for millions of employees in India, providing them with financial security and stability during their post-employment years.

– EPF contributions by both employees and employers qualify for tax saving benefits under Section 80C.

– The interest earned on EPF is tax-exempt, and the maturity amount remains tax-free if withdrawn after five years of continuous service.

E. Tax-Saving Fixed Deposits:

Tax-saving fixed deposits are a type of fixed deposit offered by banks in India that provide investors with the dual benefit of guaranteed returns along with tax savings under Section 80C of the Income Tax Act, 1961 Here’s an elaborate overview of tax-saving fixed deposits:

(i) Tax Benefits: Under Section 80C of the Income Tax Act, investments made in tax-saving fixed deposits are deductible from taxes up to a total of Rs. 15 lakh every fiscal year. Individual taxpayers and Hindu Undivided Families (HUFs) are eligible for this deduction.

(ii) Lock-in Period: Tax-saving fixed deposits typically come with a lock-in period of 5 years. Investors cannot withdraw their investment before the completion of this lock-in period. Premature withdrawal or closure of the fixed deposit is not allowed, except in specific cases like the death of the depositor.

(iii) Interest Rates: The interest rates offered on tax-saving fixed deposits are similar to regular fixed deposits but may vary from one bank to another. These interest rates are usually fixed for the entire tenure of the deposit and are compounded quarterly or annually.

(iv) Interest Payout Options: Investors can choose between different interest payout options such as monthly, quarterly, half-yearly, or annual interest payments, depending on their preference and financial goals. However, the interest earned is taxable as per the investor’s income tax slab rate.

(v) Minimum and Maximum Investment: The minimum investment amount for tax-saving fixed deposits is generally Rs. 100 or Rs. 500, depending on the bank. There is no maximum limit for investment, but tax benefits are available only up to Rs. 15 lakh under Section 80C.

(vi) Nomination Facility: Investors can nominate one or more individuals to receive the proceeds of the tax-saving fixed deposit in the event of their demise. This ensures that the accumulated savings are transferred to the nominee(s) without any hassle.

(vii) Tax Implications on Maturity: While the investment in tax-saving fixed deposits provides tax benefits under Section 80C, the interest earned on these deposits is taxable as per the investor’s income tax slab rate. The interest income is added to the investor’s total income for the financial year and taxed accordingly.

(viii) Risk Factor: Tax-saving fixed deposits are considered relatively safe investment options as they are offered by banks, which are regulated by the Reserve Bank of India (RBI). However, they are not entirely risk-free, and investors should assess the credit rating and reputation of the bank before investing.

In summary, tax-saving fixed deposits offer investors a combination of tax benefits and fixed returns, making them a popular investment choice for individuals looking to save on taxes while earning stable returns over a fixed tenure. However, investors should carefully consider the lock-in period, interest rates, and tax implications before investing in these instruments.

– Banks offer fixed deposits with a lock-in period of five years that qualify for deductions under Section 80C.

– These fixed deposits provide a secure investment avenue for individuals looking for tax saving without exposing themselves to market risks.

Emerging Tax-Friendly Investments

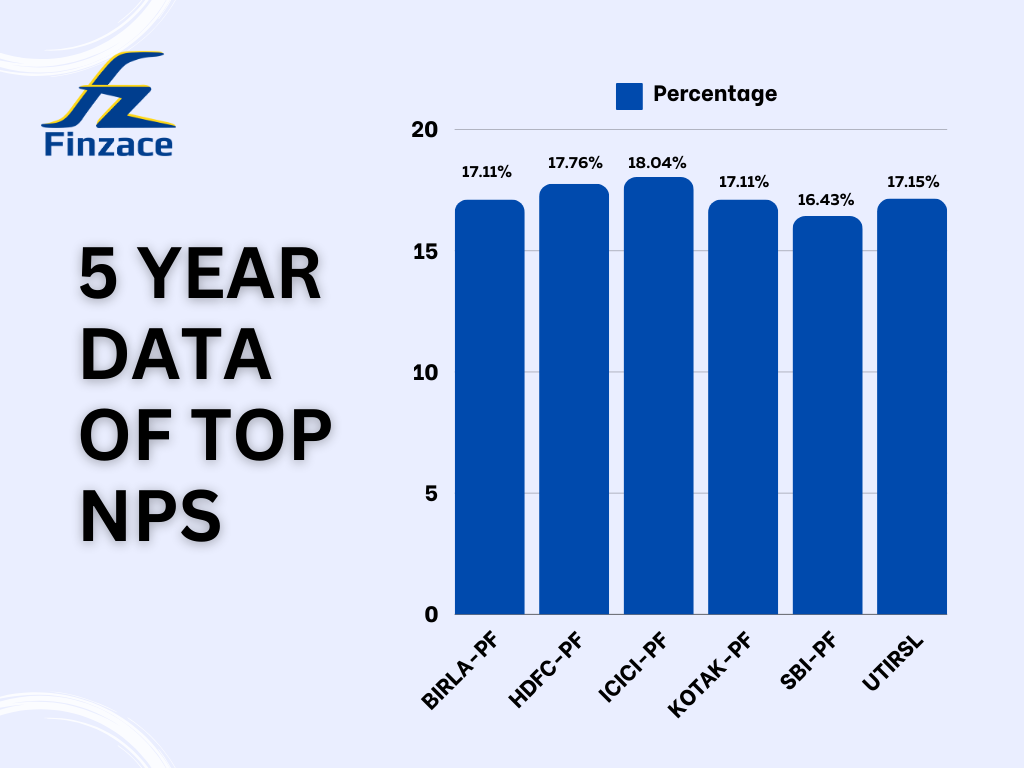

A. National Pension System (NPS):

The National Pension System (NPS) is a voluntary, contributory pension scheme introduced by the Government of India to provide retirement income to citizens. Here’s an elaborate overview of the National Pension System (NPS):

(i) Types of Accounts: NPS offers two types of accounts:

– Tier-I Account: This is a mandatory pension account that comes with certain restrictions on withdrawals. It is designed primarily for retirement planning.

– Tier-II Account: This is a voluntary savings account that offers more flexibility in terms of withdrawals. It can be opened only if the individual has an active Tier-I account.

(ii) Contributions: Both employees and employers can contribute to the NPS account. For government employees, the government also contributes to their NPS account. Contributions made to the NPS are invested in various asset classes such as equity, corporate bonds, government securities, and alternative assets based on the subscriber’s preference.

(iii) Tax Benefits: NPS offers attractive tax benefits to investors:

– Contributions made by employees and employers are eligible for tax deduction under Section 80C of the Income Tax Act, subject to a maximum limit.

– An additional deduction of up to Rs. 50,000 is available under Section 80CCD(1B) for contributions made by the individual towards the NPS Tier-I account.

(iv) Flexible Investment Options: NPS offers two investment options to subscribers:

– Active Choice: Subscribers can choose their asset allocation among Equity (E), Corporate Bonds (C), and Government Securities (G).

– Auto Choice: This option invests funds based on the subscriber’s age. It starts with a higher allocation to equities and gradually shifts to safer options as the subscriber approaches retirement age.

(v) Portability: NPS accounts are portable across jobs and locations. Subscribers can maintain the same NPS account even if they change jobs or locations. This ensures continuity and ease of management.

(vi) Withdrawal Options: Upon retirement, subscribers can withdraw a portion of their NPS corpus as a lump sum, while the remaining amount must be used to purchase an annuity that provides a regular pension income. Additionally, subscribers can make partial withdrawals for specific purposes like higher education, marriage, medical treatment, and home purchase, subject to certain conditions.

(vii) Regulation and Oversight: NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA), which oversees the functioning of pension fund managers, custodians, and other intermediaries involved in the scheme. The PFRDA ensures transparency, fairness, and investor protection within the NPS framework.

(viii) Pension Fund Managers: NPS subscribers can choose from multiple Pension Fund Managers (PFMs) to manage their investments. These PFMs invest the contributions in various asset classes intending to maximize returns while managing risk.

Overall, the National Pension System (NPS) provides an efficient and transparent platform for retirement planning, offering tax benefits, flexible investment options, and portability across jobs. It is an essential tool for individuals looking to build a retirement corpus and secure their financial future.

– NPS contributions are eligible for tax benefits under Section 80CCD(1) within the overall limit of Section 80C.

– An additional deduction of up to ₹50,000 is available under Section 80CCD(1B), making NPS an attractive retirement planning tool with significant tax-saving potential.

B. National Small Savings Fund (NSSF):

The National Small Savings Fund (NSSF) is a significant component of India’s public debt, managed by the Government of India. Here’s an elaborate overview of the National Small Savings Fund (NSSF):

(i) Purpose: The NSSF was established to mobilize savings from small investors and channel them into various government-sponsored savings schemes. It aims to provide a safe and secure investment avenue for individuals while fulfilling the government’s borrowing requirements.

(ii) Contribution Sources: The primary sources of contributions to the NSSF are investments made by individuals in various small savings schemes offered by the government, such as Public Provident Fund (PPF), National Savings Certificate (NSC), Kisan Vikas Patra (KVP), Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY), and Post Office Savings Schemes.

(iii) Management: The NSSF is managed by the Department of Economic Affairs (DEA) under the Ministry of Finance, Government of India. The Directorate of Small Savings within the DEA is responsible for administering and overseeing the functioning of the NSSF.

(iv) Investment: The funds collected through small savings schemes under the NSSF are utilized by the government to finance its various developmental and welfare programs. These funds are invested in government securities, bonds, and other approved instruments, generating returns for the NSSF.

(v) Interest Rates: The interest rates offered on small savings schemes under the NSSF are determined by the government and are subject to periodic revisions. The interest rates may vary for different schemes and are typically linked to the prevailing market rates and government bond yields.

(vi) Tax Benefits: Several small savings schemes under the NSSF offer tax benefits to investors. For example, investments made in schemes such as PPF, NSC, and SCSS are eligible for tax deductions under Section 80C of the Income Tax Act, up to specified limits.

(vii) Safety and Security: Investments in small savings schemes under the NSSF are considered safe and secure as they are backed by the sovereign guarantee of the Government of India. The government ensures the repayment of the principal amount along with the promised interest to investors.

(viii) Financial Inclusion: The NSSF plays a crucial role in promoting financial inclusion by offering accessible and affordable savings options to individuals, especially those residing in rural and semi-urban areas. The availability of small savings schemes through post offices and designated banks ensures widespread reach and participation.

Overall, the National Small Savings Fund (NSSF) serves as an important source of funds for the government while providing individuals with a range of secure savings options to meet their financial goals and requirements.

– Recently introduced, NSSF aims to offer retail investors a stable investment platform.

– While specific tax benefits are yet to be detailed, it is expected to align with existing norms under Section 80C.

C. Sovereign Gold Bond Scheme (SGB):

The Sovereign Gold Bond (SGB) Scheme is a government-backed initiative launched by the Reserve Bank of India (RBI) on behalf of the Government of India. It aims to encourage individuals to invest in gold more securely and conveniently, while also reducing the country’s reliance on physical gold imports. Here’s an elaborate overview of the Sovereign Gold Bond Scheme (SGB):

(i) Nature of Investment: SGBs are financial instruments denominated in grams of gold, issued by the RBI on behalf of the Government of India. They represent a form of government borrowing, where investors lend money to the government in exchange for gold bonds.

(ii) Security: SGBs are backed by the sovereign guarantee of the Government of India, making them one of the safest forms of gold investment available to investors. The government ensures the repayment of the principal amount along with the promised interest at maturity.

(iii) Physical Gold Equivalent: Each SGB represents a certain amount of physical gold, determined based on the prevailing market price of gold at the time of issuance. Investors receive the equivalent amount of physical gold upon maturity or redemption of the bonds.

(iv) Interest Rate: In addition to the potential capital appreciation from changes in the price of gold, SGBs also offer a fixed rate of interest on the initial investment amount. The interest rate is announced by the government periodically and is payable semi-annually. The interest earned is taxable as per the investor’s income tax slab rate.

(v) Tenure: SGBs have an eight-year fixed tenure, with the option to terminate on interest payment dates following the fifth year. Investors can also choose to exit the scheme prematurely by selling the bonds on stock exchanges where they are listed, subject to market liquidity.

(vi) Subscription Periods: The government periodically opens subscription periods for SGBs, during which investors can apply for the purchase of bonds through authorized banks, designated post offices, and stock exchanges. The subscription price is based on the prevailing market price of gold at the time of subscription.

(vii) Tax Benefits: One of the key advantages of investing in SGBs is the tax benefits they offer:

– Capital gains arising from the redemption or sale of SGBs after the 3rd year are exempt from capital gains tax.

– Additionally, the interest earned on SGBs is taxable, but investors can claim indexation benefits to reduce the tax liability.

(viii) Tradability: SGBs are tradable instruments and can be bought and sold on stock exchanges where they are listed. This provides investors with liquidity and the flexibility to exit their investments before maturity if needed.

Overall, the Sovereign Gold Bond Scheme (SGB) provides investors with an efficient and tax-efficient way to invest in gold while also earning a fixed rate of interest. It combines the safety and security of government-backed bonds with the potential upside of investing in gold.

– Managed by the RBI, SGBs promote gold investments in paper form and offer tax benefits under Section 80C.

– Investors can diversify their portfolios with gold exposure while enjoying tax advantages.

D. Real Estate Investment Trusts (REITs):

Through the use of Real Estate Investment Trusts (REITs), investors can purchase income-producing real estate assets without having to take up or manage them themselves. Here’s an elaborate overview of Real Estate Investment Trusts (REITs):

(i) Structure: REITs are typically structured as publicly traded companies or trusts that own, operate, or finance income-producing real estate across various sectors such as residential, commercial, industrial, or retail properties.

(ii) Income Generation: REITs generate income primarily through rental income from their properties, as well as from capital appreciation of the properties they own. The rental income generated from these properties is distributed to shareholders in the form of dividends, similar to dividends from stocks.

(iii) Investment Opportunities: REITs offer investors the opportunity to invest in a diversified portfolio of real estate assets with relatively small investment amounts. This allows investors to access the real estate market without the need

(iv) Liquidity: Since REITs are traded on stock exchanges, investors have access to liquidity and can buy or sell shares at market prices, unlike direct real estate investments, which can be illiquid and require a large amount of time and effort to buy or sell properties.

(v) Tax Benefits: Laws governing REITs mandate that a sizeable amount of their profits be given to shareholders as dividends. Because of this, they have favorable tax treatment, meaning that, as long as they fulfill certain conditions—like paying out at least 90% of their taxable revenue as dividends to shareholders—they are exempt from corporate income tax at the entity level.

(vi) Diversification: REITs offer investors the benefit of diversification by investing in a portfolio of properties across different geographic locations, property types, and market segments. This diversification helps reduce investment risk by spreading exposure across multiple properties and markets.

(vii) Transparency and Regulation: REITs are subject to stringent regulatory requirements and disclosure norms, which ensure transparency and accountability to investors. They are required to regularly disclose financial information, property valuations, and other relevant data to investors and regulatory authorities.

(viii) Performance Metrics: Investors can evaluate the performance of REITs using various metrics such as funds from operations (FFO), net asset value (NAV), dividend yield, occupancy rates, and rental growth. These metrics help investors assess the financial health and growth prospects of REITs before making investment decisions.

Overall, Real Estate Investment Trusts (REITs) provide investors with a convenient and tax-efficient way to invest in real estate, offering income generation, diversification, liquidity, and transparency. They are an attractive investment option for individuals seeking exposure to the real estate market while enjoying the benefits of a regulated and publicly traded investment vehicle.

– REITs are passive real estate investment vehicles that provide tax benefits under Section 80CEEA.

– Investors can participate in real estate markets indirectly while benefiting from potential rental income and capital appreciation.

E. Infrastructure Investment Trusts (InvITs):

Through Infrastructure Investment Trusts (InvITs), investors can fund infrastructure projects in India that will generate revenue. An extensive synopsis of Infrastructure Investment Trusts (InvITs) is provided below:

(i) Structure: InvITs are set up as trusts that own, operate, and manage income-generating infrastructure assets such as roads, highways, power transmission lines, airports, and renewable energy projects. They are regulated by the Securities and Exchange Board of India (SEBI) and are governed by the InvIT Regulations, 201(iv)

(ii) Income Generation: InvITs generate income primarily through long-term contractual agreements or concession agreements with project developers or government authorities. These agreements typically involve revenue-sharing arrangements, lease rentals, toll collections, or availability payments, which provide a steady stream of income to the InvIT.

(iii) Investment Opportunities: InvITs offer investors the opportunity to invest in a diversified portfolio of infrastructure assets with relatively small investment amounts. This allows retail and institutional investors to access the infrastructure sector, which was traditionally dominated by institutional investors and government entities.

(iv) Distribution of Income: InvITs are required to distribute a significant portion of their income to investors in the form of dividends. SEBI regulations mandate that InvITs distribute at least 90% of their net distributable cash flows to investors semi-annually. This ensures regular income for investors similar to dividends from stocks.

(v) Liquidity: InvIT units are listed and traded on stock exchanges, providing investors with liquidity and the ability to buy or sell units at market prices. This enhances the attractiveness of InvITs as an investment option compared to direct investment in infrastructure projects, which can be illiquid.

(vi) Tax Benefits: InvITs enjoy tax benefits similar to Real Estate Investment Trusts (REITs). They are not subject to tax at the entity level if they distribute at least 90% of their distributable cash flows to investors. Additionally, dividends received by unit holders are taxed at the individual’s applicable tax rate.

(vii) Transparency and Regulation: InvITs are subject to stringent regulatory requirements and disclosure norms prescribed by SEBI. They are required to regularly disclose financial information, project performance, and other relevant data to investors and regulatory authorities, ensuring transparency and accountability.

(viii) Performance Metrics: Investors can evaluate the performance of InvITs using various metrics such as distribution yield, net asset value (NAV), project revenue, cash flows, and project completion timelines. These metrics help investors assess the financial health and growth prospects of InvITs before making investment decisions.

Overall, Infrastructure Investment Trusts (InvITs) provide investors with an opportunity to participate in India’s infrastructure growth story while enjoying regular income, diversification, liquidity, and tax benefits. They are an attractive investment option for individuals and institutions seeking exposure to the infrastructure sector in India.

– InvITs invest in infrastructure projects and offer similar tax benefits as REITs under Section 80CEEA.

– Investors can tap into infrastructure development opportunities while enjoying tax efficiencies on their investments.

By exploring these diverse and secured investment options, investors can tailor their portfolios to achieve a balance between wealth creation and tax optimization. It is crucial to assess individual risk tolerance, investment horizons, and financial goals before selecting suitable investment instruments. Seeking guidance from financial advisors or experts can further enhance decision-making processes and ensure optimal outcomes in navigating the dynamic landscape of tax-saving investments in India.